Recent AMFI best practice guidelines require adjustments to how we process Mutual Fund transactions with invalid ARNs (AMFI Registration Numbers). This article outlines these changes and their impact on your workflow. Stay informed and ensure smooth transaction processing by reading on!

Recent changes in processing Mutual Fund transactions received with invalid ARNs (AMFI Registration Numbers) based on the new AMFI best practice guidelines issued on February 02, 2024.

What are “Invalid ARNs”?

- Expired validity period

- Cancelled/terminated

- Suspended

- Holder deceased

- MFD nomenclature non-compliant with IA Regulations

- Debarred by SEBI

- Not present in AMFI ARN database

- Not empanelled with AMC (Asset Management Company)

How will transactions be affected?

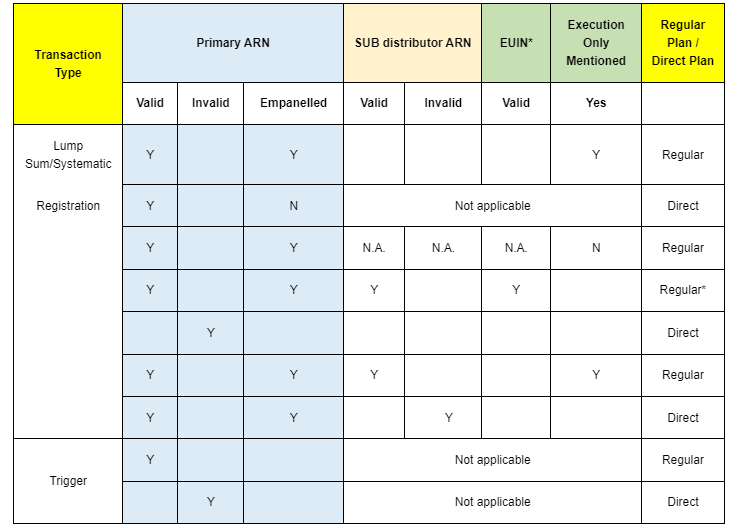

The table below summarizes the processing guidelines for Regular Plan transactions based on the validity of the Primary ARN, Sub-distributor ARN (if applicable), and EUIN:

Key Points:

- If both Primary and Sub-distributor ARNs (if applicable) are invalid, the transaction and all future triggers will be processed under the Direct Plan.

- For Systematic Investment Plans (SIPs) and Systematic Transfer Plans (STPs), both Primary and Sub-distributor ARNs will be validated during registration. If registration details are unavailable, future triggers will be treated as lump sum purchases for validation. We recommend regularly reconciling active/inactive SIPs with RTAs (using mail back report WBR49).

- Only valid “ARN-” values in the transaction form/feed will be considered for Sub-distributor ARN validation.

- Sub-distributor ARN will only be validated during SIP/STP registration, not for future triggers, provided the registration details are available in RTA records.

- SIPs registered under deceased MFDs will continue until the end of the registration period or investor’s request, based on AMFI guidelines. However, no new transactions or SIPs can be booked under the deceased MFD’s ARN after cancellation.

- In case of ARN consolidation, please share the target ARN in the transaction form or feed, not the source/old ARN.

- Transactions not adhering to the guidelines will be rejected at submission. You can re-upload them after correction.

- If the EUIN is invalid/missing, the transaction will be processed in Regular Plan, and you will have 30 days to provide a valid EUIN. The distributor/investor will not receive commission if a valid EUIN is not provided within 30 days.

- Dividend reinvestment transactions are excluded from these validations

Conclusion

Don’t miss out on commissions! By familiarizing yourself with these updates, you can ensure your Mutual Fund transactions continue processing smoothly.

This not only avoids delays and potential frustration for your clients, but also safeguards your commission income.

Remember, accurate and compliant transactions are key to maintaining a positive client experience and maximizing your earning potential in this evolving environment.