In the financial advisory business, one of the most crucial tasks is managing client data. Initially, I encountered challenges when searching for specific client details, as it would often take a lot of time, and sometimes the information couldn’t be found easily.

However, I took this as an opportunity to learn and gradually developed an efficient system to organize and manage client data effectively. Through step-by-step improvements, I now have a well-organized system in place, which allows me to access client information promptly and serve my clients more efficiently.

Currently, I have been managing about 75 percent of my work in my own style successfully. However, recently, I came across the PARA method, and I am confident that implementing this method will help me address the remaining 25 percent of my work, ensuring a comprehensive and efficient solution for all my tasks.

PARA Method for Financial Advisor

The PARA method is a knowledge organization system introduced by Tiago Forte, a productivity expert and founder of the “Building a Second Brain” course.

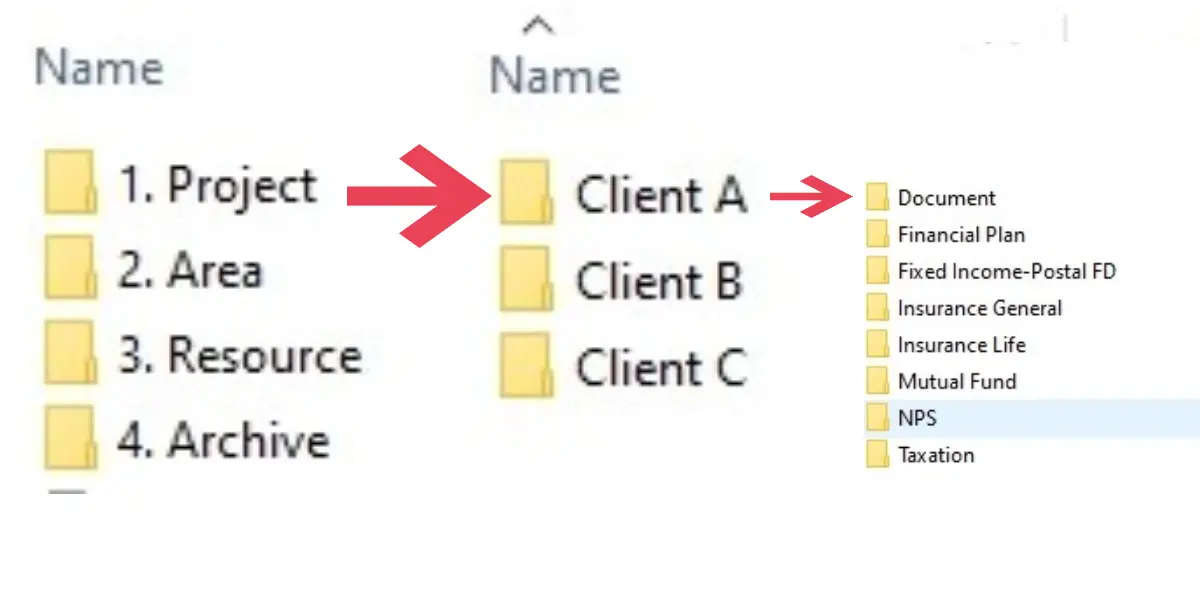

PARA stands for Projects, Areas, Resources, and Archives, and it is designed to help individuals effectively manage their digital information and increase productivity. The method aims to create a structured framework for organizing digital content and knowledge, making it easily accessible and actionable when needed.

Here’s a brief overview of each component of the PARA method:

Project:

Use the Projects category to organize information related to specific financial planning tasks or client-related projects. For instance, you might have projects for retirement planning, investment analysis, tax planning, or creating customized financial plans for individual clients. Keep all relevant documents, notes, and client communications related to each project in one place.

Area:

As a financial advisor, think about the main areas of your work. These could include helping clients with investments, retirement planning, taxes, estate planning, managing risks, communicating with clients, and continuing your professional development.

Create areas that align with different aspects of your financial advisory practice. Examples of areas could be “Investments,” “Insurance,” “Retirement Planning,” “Estate Planning,” “Client Communication,” etc. Under each area, you can store essential resources, guidelines, and best practices that pertain to that specific domain.

It’s a way to group related tasks, projects, and information together based on common themes. Each area represents a significant aspect of your financial advisory practice that you regularly engage with or need to keep track of.

Let’s explore how you can use the “Areas” category effectively as a financial advisor:

1. Identify Relevant Areas:

In this example, let’s assume our financial advisor specializes in providing comprehensive financial planning services to individual clients. The areas of focus could be:

a) Investment Management b) Retirement Planning c) Tax Planning d) Risk Management f) Client Communication g) Professional Development

Assign Projects to Respective Areas:

a) Investment Management Area:

- Research and analysis of investment opportunities in specific companies.

- Portfolio review and rebalancing for Client A.

b) Retirement Planning Area:

- Develop a retirement income strategy for Client B.

- Conduct a retirement planning workshop for a group of clients.

c) Tax Planning Area:

- Stay updated on changes in tax laws for the current financial year.

- Prepare and file tax returns for clients.

d) Risk Management Area:

- Review insurance coverage for Client C and recommend adjustments.

- Research and compare different long-term care insurance options.

f) Client Communication Area:

- Schedule regular check-ins with existing clients to discuss financial updates.

- Prepare personalized financial reports for quarterly client meetings.

Easy Access and Retrieval: The “Areas” category helps you quickly access and manage information related to specific aspects of your financial advisory practice. Instead of searching through a vast pool of data, having areas allows you to navigate directly to the relevant folder for the task at hand.

Facilitate Focus and Productivity: Organizing your work into areas helps you maintain focus on individual tasks without getting overwhelmed. It enables you to allocate your time and resources efficiently and ensures that you stay on top of essential aspects of your practice.

Client-Focused Areas: You can also create client-focused areas, where you organize information specific to each of your clients. These areas could include details of their financial plans, investment preferences, risk profiles, and any other pertinent information. It ensures you can quickly access everything you need to provide personalized and top-notch financial advice to each client.

Customize for Your Practice: Tailor the “Areas” category to match your specific advisory services and your preferred way of organizing information. You can add or modify areas based on your unique needs and the breadth of your financial practice.

By leveraging the “Areas” category effectively, you’ll create a structured and organized knowledge management system. This will significantly enhance your ability to provide comprehensive financial advisory services, manage client information efficiently, and streamline your workflow as a financial advisor.

Resource:

In the PARA method, the “Resources” section is where you store reference materials, tools, and information that you may need frequently or occasionally in your work as a financial advisor. These resources are valuable for quick access and help you stay informed and well-prepared to serve your clients effectively.

Here’s a detailed example of how a financial advisor could use the Resource section:

Identify Useful Resources:

As a financial advisor, you come across various resources that aid your work. Some examples of useful resources include:

- Market research reports on different industries or asset classes

- Financial planning templates and checklists

- Tax guidelines and updates

- Retirement planning guides and calculators

- Insurance product brochures and comparison charts

- Economic indicators and data sources

- Educational articles and whitepapers on financial topics

Organize Resources into Categories:

Within the Resource folder, create subfolders or use tags to categorize the resources logically. For example:

- Market Research

- Financial Planning Templates

- Tax Guidelines and Updates

- Retirement Planning

- Insurance Products

- Economic Indicators

- Financial Education

Keep Resources Updated:

Regularly review and update the resources to ensure they are current and relevant. Remove any outdated or obsolete materials to maintain the accuracy of your resource library.

Utilize Cloud Storage and Online Resources:

Consider using cloud storage solutions and bookmarking websites with valuable online resources. This way, you can access them from any device and easily share them with clients or colleagues.

Create Resource Summaries:

For lengthy reports or articles, create brief summaries or key takeaways to quickly grasp the main points when needed.

Annotate and Highlight:

Add annotations or highlights to PDFs or documents to mark crucial information or relevant sections.

Share with Team or Clients:

If you work with a team or have clients, consider sharing access to the Resource section, allowing them to access valuable information easily.

By maintaining a well-organized and up-to-date Resource section, you can quickly find and utilize essential reference materials in your financial advisory work. This ensures that you remain informed, well-prepared, and equipped to provide high-quality advice and solutions to your clients.

Archive:

PARA method, the “Archive” section is where you store information, documents, and resources that are no longer actively used or updated but may still be valuable for future reference. Archiving helps keep your working environment clutter-free while preserving important knowledge and historical data.

Here’s a detailed example of how a financial advisor could use the Archive section:

Identify Items for Archiving:

As a financial advisor, you may accumulate various materials, reports, and data over time. Some examples of items suitable for archiving could include:

- Outdated investment research reports

- Previous versions of financial plans for clients

- Historical market data and economic indicators

- Old client communication logs and meeting notes

- Previous versions of templates and planning tools

- Completed Financial Plans

- Old Client Projects

Organize and Label Items:

Within the Archive folder, create subfolders or use tags to organize the archived items logically. For example:

- Investment Research Reports

- Client Financial Plans (by year or client name)

- Tax Returns (by year and client name)

- Market Data (by date or topic)

- Client Communication Logs (by year or client name)

- Previous Templates and Tools

Retain Relevant Information:

Ensure that you only archive information that remains relevant and useful for future reference. Discard any obsolete or redundant items to keep the Archive section focused and easy to navigate.

Regularly Review and Update:

Periodically review the Archive section to ensure it stays current and relevant. Remove items that are no longer necessary or update outdated information if needed.

By maintaining an organized and up-to-date Archive section, you can declutter your active workspace, reduce information overload, and access valuable historical data when required.

Conclusion

In conclusion, as a financial advisor, implementing the PARA method with Google Drive as the storage platform has proven to be highly effective and efficient in organizing my data and knowledge.

The combination of Projects, Areas, Resources, and Archives within the PARA framework has provided a structured and streamlined approach to managing my digital information.

Overall, the combination of the PARA method and Google Drive has significantly improved my productivity as a financial advisor.

I can efficiently manage my data, easily address investor queries, and provide well-informed financial guidance to my clients.

This organizational system has played a vital role in elevating the quality of my services and building stronger relationships with my investors.